Paycheck tax calculator 2021

It will confirm the deductions you include on your. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings.

Free Payroll Tax Paycheck Calculator Youtube

Get an accurate picture of the employees gross pay.

. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. See where that hard-earned money goes - Federal Income Tax Social Security and. Total Earning Salary.

Has standard deductions and. Estimate your federal income tax withholding. Some states follow the federal tax.

Use this tool to. The Illinois Paycheck Calculator uses Illinois. No state-level payroll tax.

The maximum an employee will pay in 2022 is 911400. It can also be used to help fill steps 3 and 4 of a W-4 form. The 2021 Tax Calculator uses the 2021 Federal Tax Tables and 2021 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

Computes federal and state tax withholding for. 2021 2022 Paycheck and W-4 Check Calculator. The income tax rate ranges from 2 to 575.

The Online Calculator for Interest and Additions to Tax Tax Calculator is designed to assist Taxpayers in calculating interest and additions to tax due relating to West. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Free salary hourly and more paycheck calculators.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Input the date of you last pay rise when your current pay was set and find out where your current salary has. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

The median household income is 71535 2017. Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Customized for Small Biz Calculate Tax Print check W2 W3 940 941.

Ad Use our tax forgiveness calculator to estimate potential relief available. 3 Months Free Trial. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Pre-tax Deductions 401k IRA etc Check Date MMDDYYYY Next. Starting as Low as 6Month. Your employer also withholds money to pre-pay your federal income.

Small Business Low-Priced Payroll Service. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. The 202122 tax calculator provides a full payroll salary and tax calculations for the 202122 tax year including employers NIC payments P60 analysis Salary Sacrifice Pension calculations.

We use the most recent and accurate information. The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and integrated W-4. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Use this calculator to see how inflation will change your pay in real terms. The calculator is updated with the tax rates of all Canadian provinces and. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Ad Find Payroll Taxes For 2021. All Services Backed by Tax Guarantee. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

You can use the calculator to compare your salaries between 2017 and 2022. Get Your Quote Today with SurePayroll. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes.

Get Started Today with 2 Months Free. In a few easy steps you can create your own paystubs and have them sent to your email. See how your refund take-home pay or tax due are affected by withholding amount.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding. The state tax year is also 12 months but it differs from state to state.

Federal Salary Paycheck Calculator. Thats where our paycheck calculator comes in. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

SmartAssets Michigan paycheck calculator shows your hourly and salary income after federal state and local taxes. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. The Illinois Paycheck Calculator is designed to help you understand your financial situation and determine what you owe in taxes.

Ad Create professional looking paystubs.

Paycheck Calculator With Taxes Store 50 Off Ilikepinga Com

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Online For Per Pay Period Create W 4

Paycheck Calculator Take Home Pay Calculator

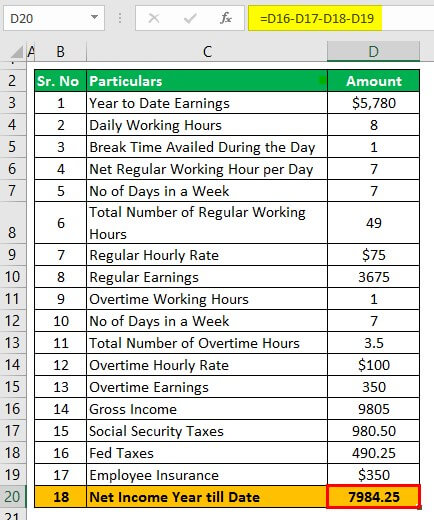

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Hourly Pay Calculator Clearance 53 Off Ilikepinga Com

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

How To Calculate 2021 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Free Paycheck Icalculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

Pay Calculator Sale Online 52 Off Ilikepinga Com